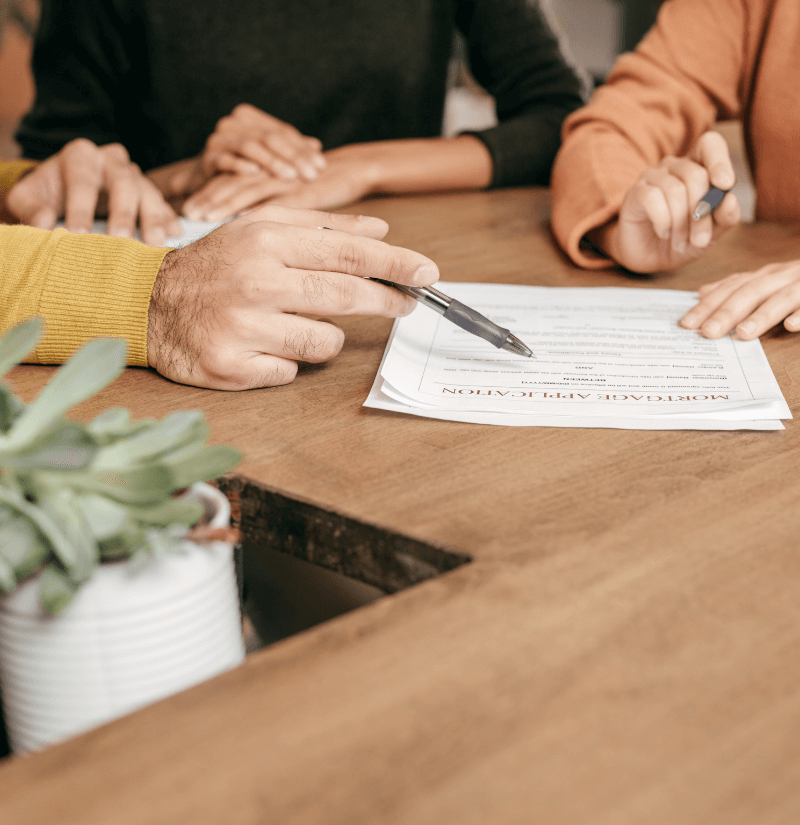

Mortgages

First Time Buyer Mortgages

Buying your first home is an exciting milestone, but it can also feel overwhelming. First-time buyer mortgages are created to make that journey easier, with features designed to support you as you step onto the property ladder.

As a first-time buyer, you may also qualify for government schemes and incentives that can help reduce costs and make homeownership more achievable. With the right guidance, you’ll be able to find a mortgage that fits your needs and gives you the confidence to move forward.

Remortgages

A remortgage simply means moving your existing mortgage to a new deal, either with your current lender or a new one. Many homeowners choose to remortgage to reduce monthly payments, secure a better interest rate, or release equity for things like home improvements, debt consolidation, or major purchases.

With the right advice, remortgaging can save you money and give you more financial flexibility, ensuring your mortgage continues to work in your best interests.

Home Mover Mortgages

Buying your first home is an exciting milestone, but it can also feel overwhelming. First-time buyer mortgages are created to make that journey easier, with features designed to support you as you step onto the property ladder.

As a first-time buyer, you may also qualify for government schemes and incentives that can help reduce costs and make homeownership more achievable. With the right guidance, you’ll be able to find a mortgage that fits your needs and gives you the confidence to move forward.

Buy to Let Mortgages

A Buy to Let mortgage is designed for those who want to purchase a property as an investment and rent it out to tenants. Unlike a standard residential mortgage, this type of loan is tailored to landlords and property investors, with eligibility often based on expected rental income as well as the overall value of the property.

Whether you’re a first-time landlord or looking to grow your portfolio, the right Buy to Let mortgage can help maximise your returns and support your long-term investment strategy.

Self-Employed Mortgages

Getting a mortgage when you’re self-employed can feel challenging, but it doesn’t have to be. Self-employed mortgages are designed for business owners, freelancers, and contractors whose income may not be as straightforward as a traditional salary.

Lenders will usually look at your recent accounts, tax returns, and overall financial stability to assess affordability. With the right guidance, you can access competitive mortgage deals tailored to your unique circumstances and secure the home you want with confidence.

Mortgages for Contractors

Contractor income can be complex, but there are mortgages designed to fit your way of working. Whether you’re on short-term contracts or long-term projects, lenders will consider your contract history and earnings to help you secure the right deal. With expert advice, getting a mortgage as a contractor can be simpler than you think.

Mortgages for Doctors

Doctors often have unique income structures, from training contracts to NHS salaries and private practice earnings. Specialist mortgages for doctors take these into account, making it easier to secure a competitive deal that suits both your career and lifestyle.

Mortgages for Teachers

Teachers have access to specialist mortgage options that recognise the stability of their profession, even with varied contracts or additional income from tutoring. These mortgages are designed to help education professionals secure affordable deals that fit their lifestyle and career.